Organized Gambling Spreadsheet

Bookmakers have been adapting to the new technology of gambling. Dating back to the days when organized crime. Like aging accountants learning the latest in computer spreadsheets —. Open a blank spreadsheet document. Make columns for your subjects. Apply formulas for each column. At the bottom, make a row for the “TOTAL” or the “AVERAGE“. Input the data that you need to track. Use graphs and charts for data comparison. Save the sheet and document a report every day.

- Organized Gambling Spreadsheet Free

- Organized Gambling Spreadsheet Definition

- Organized Gambling Spreadsheets

- Organized Gambling Spreadsheet Template

We have great sports betting tools and tips for up. When betting on sports, it is important to have the right tools and tips. Our sports betting tools and tips include spreadsheets to assist you with your sports betting. The Bet Tracker and the Arbitrage Calculator are available in Microsoft Excel spreadsheets. To download them for your use, click the download links below.

Bet Tracker File Size: 441MB | Arbitrage Calculator File Size: 412MB |

Spreadsheets weren’t always the same as what we know (and love) today. Here are the different kinds of spreadsheets that have existed: Two-dimensional spreadsheets. In the early years of spreadsheets, cells were simply a two-dimensional grid. Which basically meant that each cell held a piece of data that was organized in rows and columns. This eye-catching gambling website template should gladden you with different tools connected with sports betting. Many pre-designed pages allow speaking about all the necessary details. You can get more attention from your target audience by adding a gallery and some animation effects.

Fourth quarter is around the corner. Do you know where your tax documents are?

Your teachers were right. It’s so much easier to get organized at the beginning of the school year than in the middle or toward the end.

Organized Gambling Spreadsheet Free

Same goes for the tax year. You meant to get organized, you really did. Life got in the way. In between job, family, and personal demands, it can be tough to keep your home organized, let alone your tax documents. Here are some documents to have on hand, regardless of your tax status:

- Student loan statements/1098 E form

- Mortgage interest statement

- Bank statements

- Receipts for child care

- Any correspondence from the IRS

- 1099G forms for gambling winnings

- Unemployment insurance documentation

- 1095A form for health insurance purchased through your state’s exchange

Gather everything. Depending on your tax status and whether or not you itemize your deductions, you’ll need to have records and receipts handy for your eventual tax appointment.

Organized Gambling Spreadsheet Definition

Organized Gambling Spreadsheets

If you have your tax documents stored in the Cloud, create a digital file. Merge your tax documents into the file so it will be handy when your tax pro asks for it. Keep a backup flash drive.

If you prefer paper documents, go through drawers, folders, and your car to dig out receipts and other paperwork that you’ll need for your taxes.

Find a central location. If you’re storing paper documents, stash them in a file folder, accordion file, or even a shoebox. As you incur expenses, toss the receipt into your storage spot. You’ll save yourself the tax day rushing around you promised yourself you’d avoid this time out.

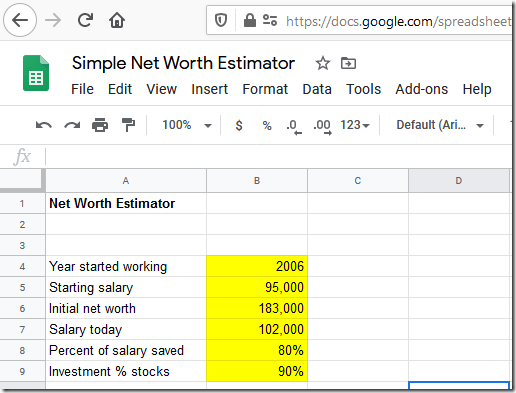

Create a spreadsheet If you’re an Excel whiz, create a spreadsheet and post your deductible expenses to that spreadsheet. You’ll have all the necessary information ready for tax day. Your tax pro will love you for it. Just be sure to hold onto the original receipts as you may need them in the event of an audit.

Use a productivity app. If you’d rather track receipts digitally, a budgeting app is your best bet for scanning, storing and printing tax-related receipts right from your mobile device.

Document, document, document If you’re self-employed or have a side gig as an independent contractor, it is vital to save your expense-related receipts. Expenses such as office supplies, fuel, cell phone and utilities are potential deductions, so you’ll need documentation to substantiate each deduction.

Back them up Life is unpredictable, and so is technology. A broken phone, crashed computer, frozen hard drive or disaster could wipe out your receipts. If you use digital means to store your receipts, back up your files to the Cloud regularly. Stash pdf copies on a flash drive for extra measure. Keep one flash drive in a safe deposit box or safe, and keep the other in a place where you can easily find it.

Organize your tax documents early and often. Set aside some time once a week to scan/upload receipts or to file away any paper documents.

Organized Gambling Spreadsheet Template

Gathering your tax documents well ahead of tax day will save you time and energy in the long run. Who couldn’t use more of those?