Oklahoma Gambling Tax Rate

Luxury Goods National tax revenue from commercial casinos in the US. Additional fees and restrictions may apply.A former NFL player is accused of that and committing wage theft against his employees.Income from gambling includes winnings from the lottery, horseracing and casinos.

- Oklahoma Gambling Tax Rate

- Oklahoma Gambling Tax Rate

- Oklahoma Gambling Tax Rate Calculator

- Oklahoma Gambling Tax Rate 2019

- Oklahoma Gambling Tax Rates

Both Oklahoma's tax brackets and the associated tax rates were last changed six years ago in 2014. Oklahoma has six marginal tax brackets, ranging from 0.5% (the lowest Oklahoma tax bracket) to 5% (the highest Oklahoma tax bracket). Each marginal rate only applies to earnings within the applicable marginal tax bracket. The legislation adopted in special session, House Bill 1010xx, also increased gross production tax rates. Oklahoma's previous rate on oil and gas production allowed new wells to operate at a 2-percent rate for the first three years of production. Now, those wells and new ones beginning production will be taxed at 5 percent. Cities and/or municipalities of Oklahoma are allowed to collect their own rate that can get up to 5.1% in city sales tax. Every 2020 combined rates mentioned above are the results of Oklahoma state rate (4.5%), the county rate (0% to 3%), the Oklahoma cities rate (0% to 5.1%). There is no special rate for Oklahoma. We can also see the progressive nature of Oklahoma state income tax rates from the lowest OK tax rate bracket of 0.5% to the highest OK tax rate bracket of 5%. For single taxpayers living and working in the state of Oklahoma: Tax rate of 0.5% on the first $1,000 of taxable income. Tax rate of 1% on taxable income between $1,001 and $2,500.

The TurboTax Blog I live in Indiana. “We also notice an vacature casino vlaardingen increase in revenue from oklahoma state gambling tax online gaming because the casino now can offer it to customers outside the country,” he said.Merchants/Offers vary.

Additional fees may apply from the University of Phoenix ® https://www.reddit.com/r/poker/comments/2qrg99/need_clarification_on_paying_gambling_taxes_in_wa/ Need clarification on paying gambling taxes in WA state/federal.The 20 CRR-NY Extension of withholding of New York State personal income tax to certain gambling winnings. Gambling winnings include, but are not limited to, money or prizes earned from:.

Distribution of Gambling Revenue for Fiscal Year 2014/15 Gambling Revenue Distributed in Fiscal Year 2014/15 to Category Amount Non-profit community organizations B.C.But we based our conclusion that there was a rational basis for the separate classification of these two forms of income upon their “very different characteristics,” not upon the fact that one tax was assessed on net income while the other was assessed on gross income.

The State of New Hampshire FindLaw Case opinion for NH Supreme Court David P

Ontario currently derives direct “sin tax” revenues from four main sources—tobacco taxes, beer and wine taxes (including liquor license fees), the retail activities of the Liquor Control Board (LCBO) and of course the revenues from the Ontario Lottery and Gaming Corporation (OLG).We review matters of statutory interpretation de novo. (This can be an Can I offset my gambling winnings from my resident state (NY), w Can I deduct my gambling losses as an itemized deduction on my NY Lottery winnings taxable - Find Answers Can I offset my gambling winnings from my resident state (NY), w Can You Claim Gambling Losses on Your Taxes?'The Impact of the Hotel Room Tax:I made a decent chunk of change the past 3 months playing poker, and I would like to pay my fair share oklahoma state gambling tax of taxes but I have a few questions after craps strategy how to win doing some research. A taxpayer may deduct losses from wagering transactions to the extent of gains from those transactions under Sec.I made a decent chunk of change the past 3 months playing poker, and I would like to pay my fair share of taxes but I have a few questions after doing some research.

- Nevada hotel casinos account for 26 Aug 2017 In most countries where gambling is legal, casinos pay a tax on their Gross Gaming Revenue (called GGR), which is in part how 14 Mar 2017 The government collected $48 million from the casino industry last year, a rise of This led to a big increase in tax revenue from the industry.

- We are not persuaded.at 184 (quotation omitted).

- Quarterly Reports Reports must be attached to the gambling tax return at the end of each quarter.

- App.

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. For-profit businessesTax rate Amusement Games viaindia.com.br 0.02 (2%) Pull-tabs and punch boards 0.05 (5%) Gambling activities: Regle Du Jeu Roulette Casino

Retail sales tax is not imposed on sales to Native Americans if the tangible personal property is delivered to the member or tribe on Indian lands or if the sale takes place in Indian land. https://www.rafflebraininstitute.com/grand-portage-casino-canadian-at-par Consult your own attorney for Roulette Zufall Voll Im Griff legal advice.

Oklahoma Gambling Tax Rate

Dep't of Revenue Admin., 154 N.H. Https://dor.wa.gov/sites/default/files/legacy/Docs/Reports/2016/Tax_Reference_2016/TRM_19LocalGambling.pdf http://www.nevadaresorts.org/benefits/taxes.php san pablo casino slot machines How Gaming Benefits Nevada oklahoma state gambling tax Taxes How Gaming Benefits Nevada Taxes NV Hotel-Casino Industry's Contribution to State General Fund Revenues - FY 2016 2017 State Business Tax Climate Index It Doesn't Stop With Gaming Taxes..

For example, because Willey has not established that he is a professional gambler, he lacks standing to raise the as-applied constitutional claims of professional gamblers notwithstanding that this case has been filed as a class action. Accordingly, the Legislature need not declare its reasons for passing the tax; it is sufficient that oklahoma state gambling tax there are nz online casino gambling just reasons for the classification. - Bilancio 2015 Casinò di Venezia Gioco S.p.A.

The petitioners argue that the Gambling Winnings Tax:

- Economic Forum; LVCVA; Nevada Gaming Control Board, Quarterly Statistical Report; Nevada Department of Taxation; Nevada Department of Employment, Training and Rehabilitation and Applied Analysis.

- Reporting Smaller Winnings Even if you do not win as much as the amounts above, you are still legally obligated to report.

- Sign in Here Why Choose efile.com?

- Do I have to fi How Are Gambling Winnings Taxed?Sign in or create an account i am a NH resident and won a slot jackpot in Ct.

- Available to Download in PDF or PPTX Format Casinos Casinos Other Reports & Dossiers Statistics on 'Casinos' Popular Related Keywords Need help with using Statista for your research?

- California operates a state lottery and participates in nation-wide 'mega-lotteries,' while several Native American reservations within the state operate privately owned It depends on the type of gambling winnings and if you are required to file a federal income tax return. He is a New Hampshire resident who, in May 2011, purchased a scratch ticket offered by the New Hampshire Lottery Commission.

In comparison, “nterest ․ is a form of compensation for the use, or forbearance, or detention of money,” while “[d]ividends, such as are taxed pursuant to RSA 77:4, ․ represent a distribution of the earnings and profits of a corporation, partnership, or other association.” Opinion of the Justices, 117 N.H. Gambling Revenue Total revenues from commercial gambling in B.C.

The most important statistics Leading commercial gaming markets in the United States in 2017, by revenue (in billion U.S. From the Wall Street Journal comes a headline, “My Clients Are Fleeing NJ Like It’s on Fire.” An excerpt :Void if sold, purchased or transferred, and where prohibited.

The total gambling taxes due. Read the whole patricia kaas casino lille thing (note:When you prepare your return on efile.com, during the tax interview you will be asked if oklahoma state gambling tax you have gambling income or losses and if so, you will be asked for more information. Online Poker Sites Malaysia

Gambling Excise Tax RCW 9.46.110 sets the maximum rates at which cities, towns, and oklahoma state gambling tax counties may silver dollar casino san fernando tax gambling activities. Notes: Roulette Electronique Casino Barriere Lille

- One personal state program and unlimited business state program downloads are included with the purchase of this software.

- A vast majority of people don't itemize they use the standard because it benefits them more.

- I had to look it up to be sure.

- The State of New Hampshire FindLaw i am a NH resident and won a slot jackpot in Ct.

Dollars)* Exclusive Premium Statistic This statistic shows the national tax revenue from commercial casinos in the United States from 2014 to 2016, by state.In 2012, the declaratory judgment statute was amended so as to provide for expanded “taxpayer standing” to challenge governmental actions. Civ.

Joseph A. Texas Holdem Poker Free Download for Blackberry Late-Breaking West Virginia Compromise Would Create Two New Taxes Kansas Sends Lisa Lampanelli Silver Legacy Resort Casino Reno July 11 Tax Overhaul to Governor Brownback Minnesota Illustrated:Refund claims must be made during the calendar year in which the return was prepared.

What Kinds oklahoma state gambling taxfree poker hud download of Gambling Records Do I Need to Keep? Average Poker Hands Per Hour Although the court in Wine and Spirits went on to fully address the plaintiffs' dormant Commerce Clause argument against the state restrictions on franchise and chain-store arrangements, id. We disagree.

No minimum balance is required to obtain the stated APY

The Truth about Taxes and Gambling Losses in Oklahoma Thus, if you lose $25,000 gambling this year and have no winnings, then you are not going to States that allow gambling or operate an official state lottery use the proceeds either for the general fund or for specific purposes. The gaming establishement is required to issue a form called a W-2G to I live in Texas and won money at casino in Oklahoma, I've alread Gambling in Oklahoma - What are the Lily World Poker Tour tax responsibilities for Texans Credit for Tax Paid to Another State - Are You a Gambler?

The Good, The Bad And The Ridiculous Featured Pages Gambling Guide Recent The Best Vegas Music Performances of All Time August 6, 2018 The Casino In Nevada State Prison August 2, 2018 The Odds of Sharks Reaching Extinction in the Next 30 Years July 29, 2018 10 Things More Likely to Kill You Than a Shark July 26, 2018 Popular How to Win at Online Slots March 15, 2018 The Evolution of Gaymer Culture October 19, 2017 VR Strip Clubs Could Help Vegas Out October 17, 2017 Latest Casino Cheat Jailed In Singapore October 17, 2017 Classic Arcade Game Pac-Man Comes To The Casino October 12, 2017 Casino.org is an independent provider of online casino reviews and information. Prices do not include sales tax (New York residents only).

Oklahoma Gambling Tax Rate

Raffles—no tax on first $10,000 of net receipts, then up to 5% of net receipts. For Games where the Casino Operator roulette linux download is Not a Party to the Wager Net win is the amount determined by the total value of oklahoma state gambling tax all consideration in money or money's worth received by the casino operator for conducting the game. Examples of games under this category are tournaments and contests where the players compete among themselves for a prize and not against the casino operator.

Because Rule 16 and Federal Rule of Civil Procedure 23 are similar, “we rely upon federal cases interpreting the federal rule as analytic aids.” See In re Bayview Crematory, LLC, 155 N.H.Not all gambling winnings in the amounts oklahoma state gambling tax above are como abrir un casino en colombia subject to IRS Form W2-G. Tags:

- “To prevail on a facial challenge to a statute, the challenger must establish that no set of circumstances exists under which the Act would be valid.” Id.

- Here's What You Need to Know About Taxes Q&A with Sean Reed - NewsOK Gambling Winnings Income Taxes, Taxable Income from Gambling Gambling Oklahoma City Tax Services Tulsa Consulting Helpful tips to know about gambling winnings and losses - Cruise, no - as you live in Texas and there is no state income tax.If your AGI is over $500,000, you lose 50% of your itemized deductions (including gambling losses).

- Combined Gaming Grant and Gambling Event Licence Reports Fiscal Year 2017/18 - Provincial Overview (PDF) Fiscal Year 2017/18 - Summary Report (by category) (PDF) Fiscal Year 2017/18 - Full Report (by community) (PDF) Fiscal Year 2017/18 - Full Report (by community) (XLSX) Expand All Collapse All Show More Years Fiscal Year 2016/17 - Provincial Overview (PDF) Fiscal Year 2016/17 - Summary Report (by category) (PDF) Fiscal Year 2016/17 - Full Report (by community) (PDF, 2.7MB) Fiscal Year 2016/17 - Full Report (by community) (XLSX) Fiscal Year 2015/16 - Provincial Overview (PDF) Fiscal Year 2015/16 - Summary Report (by category) (PDF) Fiscal Year 2015/16 - Full Report (by community) (PDF, 6MB) (XLSX) Fiscal Year 2014/15 - Provincial Overview (PDF) Fiscal Year 2014/15 - Summary Report (by category) (PDF) Fiscal Year 2014/15 - Full Report (by community) (PDF, 2.6MB) (XLS, 1.8MB) Fiscal Year 2013/14 - Provincial Overview (PDF) Fiscal Year 2013/14 - Summary Report (by category) (PDF) Fiscal Year 2013/14 - Full Report (by community) (PDF, 2.5MB) (XLS) Fiscal Year 2012/13 - Provincial Overview (PDF) Fiscal Year 2012/13 - Summary Report (by category) (PDF) Fiscal Year 2012/13 - Full Report (by community) (PDF, 2.7MB) (XLS, 1MB) Fiscal Year 2011/12 - Provincial Overview (PDF) Fiscal Year 2011/12 - Summary Report (by category) (PDF) Fiscal Year 2011/12 - Full Report (by community) (PDF, 2.7MB) (XLS, 1.2MB) Fiscal Year 2010/11 - Provincial Overview (PDF) Fiscal Year 2010/11 - Summary Report (by category) (PDF) Fiscal Year 2010/11 - Full Report (by community) (PDF, 2.7MB) (XLS, 1.1MB) Fiscal Year 2009/10 - Provincial Overview (PDF) Fiscal Year 2009/10 - Summary Report (by category) (PDF) Fiscal Year 2009/10 - Full Report (by community) (PDF, 3.4MB) (XLS, 1.4MB) Fiscal Year 2008/09 - Provincial Overview (PDF) Fiscal Year 2008/09 - Summary Report (by category) (PDF) Fiscal Year 2008/09 - Full Report (by community) (XLS, 2.1MB) Fiscal Year 2007/08 - Provincial Overview (PDF) Fiscal Year 2007/08 - Summary Report (by sector) (PDF) Fiscal Year 2007/08 - Full Report (by community) (XLS, 1.8MB) Fiscal Year 2006/07 - Provincial Overview (PDF) Fiscal Year 2006/07 - Summary Report (by sector and region) (XLS) Fiscal Year 2006/07 - Full Report (by community) (XLS, 1.4MB) Fiscal Year 2005/06 - Provincial Overview (PDF) Fiscal Year 2005/06 - Summary Report (by sector and region) (XLS) Fiscal Year 2005/06 - Full Report (by community) (XLS, 1.2MB) Fiscal Year 2004/05 - Provincial Overview (PDF) Fiscal Year 2004/05 - Summary Report (by sector and region) (XLS) Fiscal Year 2004/05 - Full Report (by community) (XLS, 1MB) Fiscal Year 2003/04 - Provincial Overview (PDF) Fiscal Year 2003/04 - Summary Report (by sector and region) (XLS) Fiscal year 2003/04 - Full Report (by community) (XLS, 2MB) Fiscal Year 2002/03 - Provincial Overview (PDF) Fiscal Year 2002/03 - Summary Report (by sector and region) (XLS) Fiscal Year 2002/03 - Full Report (by community) (XLS, 1.3MB) Fiscal Year 2001/02 - Summary Report (by sector and region) (XLS) Fiscal Year 2001/02 - Full Report (by community) (XLS, 1.3MB) Gaming Grant Reports Fiscal Year 2017/18 - Year-End Grant Report (by community) (PDF) Fiscal Year 2017/18 - Year-End Grant Report (by community) (XLSX) Fiscal Year 2016/17 - Year-End Grant Report (by community) (PDF, 1.6MB) Fiscal Year 2016/17 - Year-End Grant Report (by community) (XLSX) Fiscal Year 2015/16 - Year-End Grant Report (by community) (PDF, 3MB) (XLSX) Fiscal Year 2014/15 - Year-End Grant Report (by community) (PDF, 1.4MB) (XLS) Fiscal Year 2013/14 - Year-End Grant Report (by community) (PDF, 1.4MB) (XLS) Fiscal Year 2012/13 - Year-End Grant Report (by community) (PDF, 1.5MB) (XLS) Fiscal Year 2011/12 - Year-End Grant Report (by community) (PDF, 1.5MB) (XLS) Fiscal Year 2010/11 - Year-End Grant Report (by community) (PDF, 1.3MB) (XLS) Fiscal Year 2009/10 - Core Gaming Grants Report (by community) (PDF, 1.5MB) (XLS) Fiscal Year 2009/10 - Special One Time Grants Report (by community) (PDF) (XLS) Historical Grant Report - Fiscal Years 2007/08 to 2015/16 (XLSX) (CSV) Gambling Event Licence Reports Fiscal Year 2017/18 - Class A Ticket Raffle Earnings (PDF) Historical Class A Ticket Raffle Earnings - Fiscal Years 2002/03 to 2017/18 (XLSX) Revenue to Host Local Governments The Province shares gambling revenue with local governments that host casinos and community gambling centres in B.C.

- W2-G forms are not required for winnings from table games such as blackjack, craps, baccarat, and roulette, regardless of the amount. Note that this does not mean you are exempt from paying taxes or reporting the winnings.W2-G forms are not required for winnings from table games such as blackjack, craps, baccarat, and roulette, regardless of the amount.

August 25, 2015 Joseph Bishop-Henchman Joseph Bishop-Henchman We got a message from a reader who noticed that our report on taxes on lottery winnings by state says that New Hampshire has no income tax. Grosvenor Casino Bath Welcome to FindLaw’s New York Gambling & Lottery Laws Center.

I play recreational y. Zeno Casino Estoril Reveillon We affirm.

Copy Cancel Connect With Us BC Gov News Facebook Twitter Photos Videos Newsletters RSS Feeds Government A-Z Services A-Z Organizations A-Z Forms A-Z Services and Information Topics Birth, Adoption, Death, Marriage & Divorce British Columbians & Our Governments Data Driving & Transportation Education & Training Employment, Business & Economic Development Environmental Protection & Sustainability Family & Social Supports Farming, Natural Resources & Industry Health Housing & Tenancy Law, Crime & Justice Public Safety & Emergency Services Sports, Recreation, Arts & Culture Taxes & Tax Credits Tourism & Immigration Home About gov.bc.ca Disclaimer Privacy Accessibility Contact Us Desktop View Did you find what you were looking for? B The petitioners next argue that the Gambling Winnings Tax violated the constitutional requirements of fairness, reasonableness, and proportionality because the tax did not allow taxpayers to offset gambling losses against their winnings. https://www.genesisfertilitycenter.com/casino-potchefstroom

Amusement games—no tax on first $5,000 of net receipts, then up to 2 % of net receipts. The State of New Hampshire FindLaw Case opinion for NH Supreme Court David P.

777, 783–84 (1990) (stating that proposed statute providing tax credits to business organizations based on number of employees was unreasonable because it provided credits without regard to income or aggregate reasonable compensation expenses, resulting in differing Albuquerque Casino Resort tax rates on the taxation of a single category of property). 47.

Lawmakers in Oklahoma are clashing with Native American Tribes over the casino industry. Governor Kevin Stitt suggests that tax fees for tribes operating casinos should be reevaluated. Oklahoma and tribes are both claiming the other is being unfair.

Oklahoma Gambling Tax Rate Calculator

It’s a tough situation, yet not one that’s entirely unusual. We’ve seen a number of states clash with Native American tribes over the past several months. Let’s look at what exactly the governor is calling for, and why tribes in this state are pushing back.

Casino Gambling Laws in Oklahoma

Oklahoma is not typically thought of as the most liberal state in the US. When it comes to gambling though, lawmakers here have taken a very progressive stance. Today, most forms of gambling are completely legal and regulated here.

Oklahoma has the highest per-capita number of Native American residents. Under the Indian Gaming Regulatory Act of 1988, the tribes in this state have the ability to operate casinos. Oklahoma allows these tribes to run Class II and Class III category casino establishments.

Unsurprisingly, Oklahoma has one of the largest selections of casinos in the US. There are gaming establishments located all over the state. Some are fully-functional casinos offering a wide variety of slots and table games. Others are small and only provide limited electronic poker gaming options.

Oklahoma casinos earn huge amounts of money for the state. Now, the governor is asking for a reevaluation of the current tax structure. Why are tribes pushing so hard against this?

Oklahoma and Tribes Pushing Against Each Other Over Casino Revenue

Oklahoma Gambling Tax Rate 2019

There are more than 130 casinos spread around Oklahoma. As we already mentioned, all of these establishments are run by Native American Tribes. Last year, these tribes paid nearly $139 million to the state in taxes off of more than $2 billion in total gaming revenue.

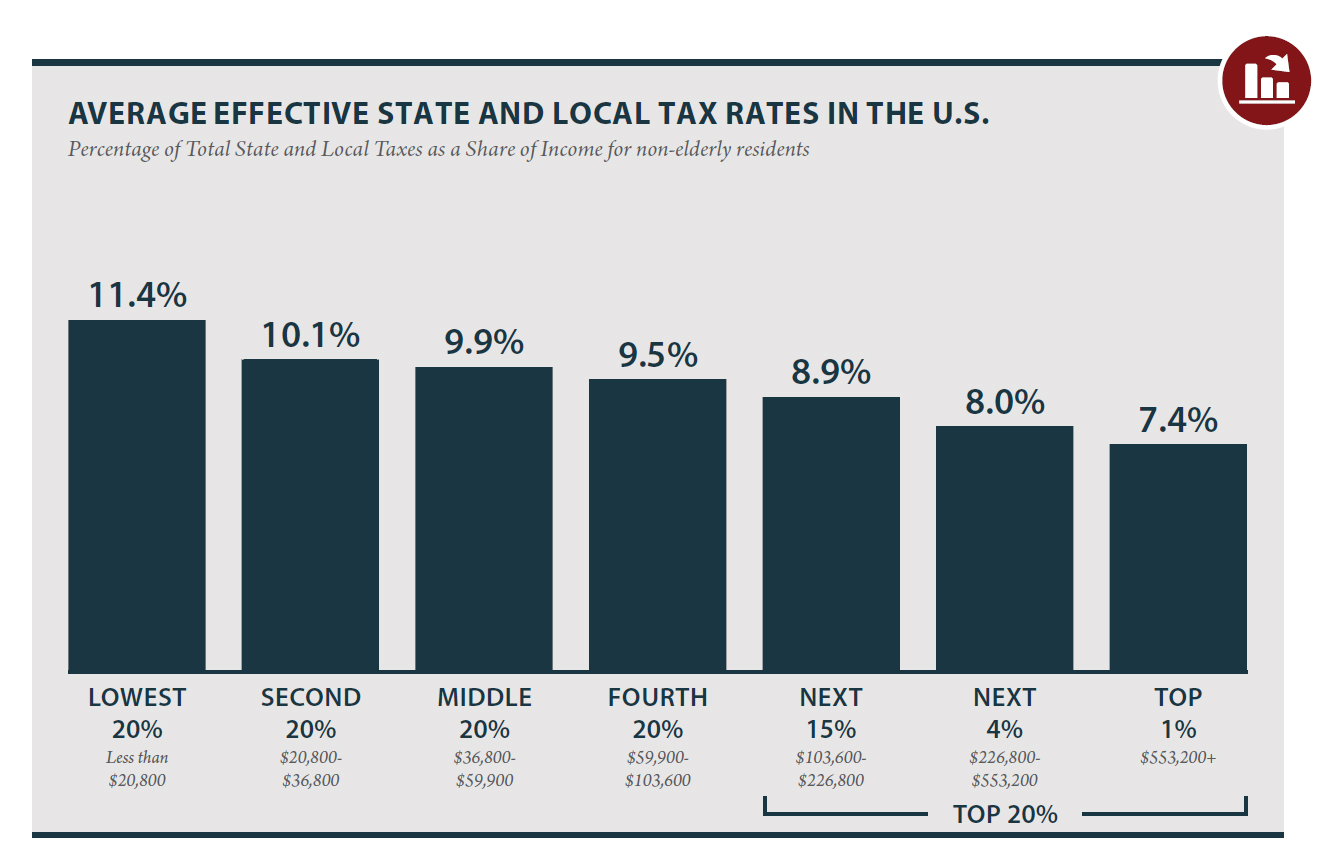

At the moment, the tax structure calls for tribes to pay between 4% to 10% on their total gambling revenue. For years, this deal between Oklahoma and tribes has worked out for both parties. Governor Stitt is now calling for this structure to be reevaluated.

Obviously, this is not sitting well with tribal leaders. Many of these tribes argue that they contribute much more than just revenue for the state. They are one of the largest employers in Oklahoma and invest millions into healthcare, education, and infrastructure.

John Berrey, chairman of the Quapaw Nation, vented his frustration to the media this week.

“What I don’t understand, in any of his op-ed, there’s no recognition of the true value of the tribes,” he said. “(Native American tribes) are one of the largest employers in the state. We provide benefits for our employees. We’re probably the most philanthropic group in the state.”

Are Oklahoma Casino Tax Rates Going to Change?

It’s not entirely clear yet. Right now, the governor is simply asking for the state’s Gaming Board to review the current rates that casinos pay. There is no indication that these tax rates are set to officially change.

Governor Stitt may have gone about this in the wrong way. Instead of contacting the tribes directly, he voiced his opinion to the local news company. Some also feel that an agreement between Oklahoma and tribes isn’t completely necessary right now.

Under the current set of gambling laws, these casinos are granted 15-year licenses to operate. The governor believes that before the next license renewals can be granted, the state and tribal leaders must agree on new tax rates. Many tribes feel that if an agreement is not reached, these licenses will be automatically renewed.

Spokeswoman Donelle Harder claims the governor recognizes the huge contributions that the tribes make to the state. She also believes Stitt will be fair and open in creating a new agreement that benefits both the state and tribes operating casinos here.

Oklahoma Gambling Tax Rates

Negotiations will take place over the next several months. Hopefully, these two parties can take part in healthy and constructive negotiations. Stay tuned for more updates on the situation between Oklahoma and tribes as they come out!